AI Agents Are About to Spend Real Money

Agentic Commerce and the Bull Case for Shopify, Amazon and eBay

Disclaimer: This publication and its authors are not licensed investment professionals. Nothing posted on this blog should be construed as investment advice. Do your own research.

Agentic commerce sounds abstract, but the underlying idea is straightforward. Instead of software that helps you shop by surfacing options or recommendations, you now have software that can actually act. An AI agent like ChatGPT or Gemini can search, compare, decide, and complete a purchase based on rules the user sets ahead of time.

That shift matters because ecommerce has always been organized around human-driven steps. Search, browse, click, compare, checkout. Once software starts collapsing those steps into a single automated flow, the question becomes less about user experience and more about which systems the agents trust to execute reliably.

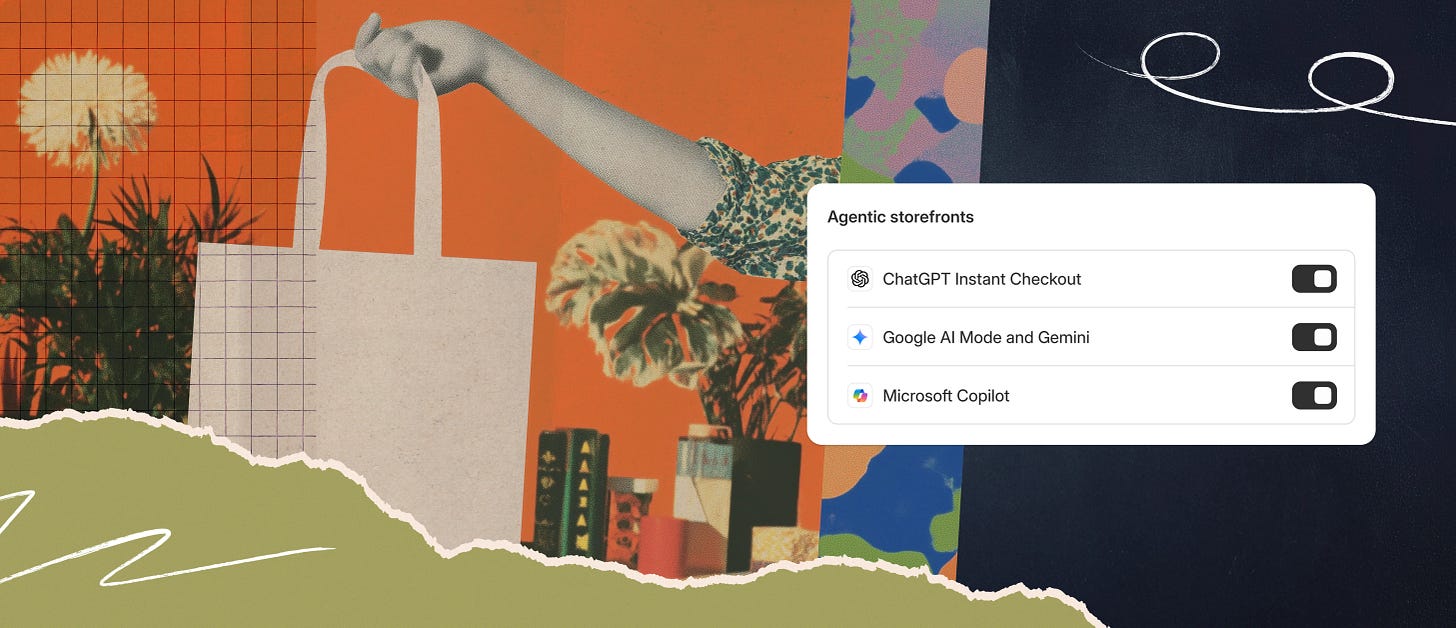

Shopify: Designing for AI as the Customer

Shopify has been unusually clear about where it wants to sit in this new setup. In its announcement on AI commerce at scale, Shopify focused less on storefront design and more on making commerce primitives readable and usable by AI systems.

The idea is that an agent should be able to access a merchant’s catalog, understand pricing and availability, and complete a transaction without forcing the merchant to rebuild anything or manage one-off integrations. Shopify wants to handle that complexity once, at the platform level, and let everyone else plug in.

As Shopify VP Vanessa Lee put it:

“Agentic commerce has so much potential to redefine shopping, and we want to make sure it can scale to every product a customer might want to purchase.”

- Shopify News, AI commerce at scale Source: https://www.shopify.com/news/ai-commerce-at-scale

What’s interesting here is that Shopify isn’t trying to own the AI interface itself. It’s positioning itself as the execution layer that sits underneath whatever interface the user prefers. From an investment perspective, that matters because it changes Shopify’s role over time. Early on, it’s a merchant tool. At scale, it starts to look more like shared infrastructure that other systems depend on.

If agentic commerce grows, merchants won’t want to think about which AI model, search engine, or assistant their customers are using. They’ll want a backend that “just works” across all of them, and that’s the slot Shopify is aiming for.

Adobe (Magento): Capable, but Harder to Standardize

Adobe’s exposure to ecommerce comes mainly through Magento, which serves a different part of the market. Magento is flexible and powerful, especially for large brands with custom needs, but that flexibility comes at the cost of uniformity.

That tradeoff becomes more visible in an agent-driven world. Autonomous systems work best with predictable, standardized surfaces. Magento deployments tend to vary widely, with integrations handled by agencies or internal teams and business logic spread across multiple layers.

Adobe’s broader AI push is focused on content, personalization, and analytics, which are valuable but sit upstream from the actual transaction. For agentic commerce, the bottleneck isn’t creativity or targeting, it’s execution.

As a result, agentic commerce is more of an indirect tailwind for Adobe. It supports demand for orchestration tools, but unless Adobe aggressively simplifies how Magento exposes commerce functionality to agents, it’s unlikely to become the default transaction backend in the same way Shopify is trying to be.

Amazon: Built for This, but With Different Tradeoffs

Amazon already operates close to what agentic commerce looks like in practice. The company has spent years optimizing for speed, convenience, and minimal user effort, all backed by a tightly integrated logistics and payment system.

The potential tension isn’t about whether AI agents increase ecommerce volume. It’s about who controls the interaction layer. If purchasing increasingly happens inside AI assistants or search tools run by others, Amazon may still fulfill the order but lose some control over the customer relationship.

That helps explain why Amazon has been cautious and sometimes defensive around third-party AI shopping tools. It suggests the company sees agentic commerce as strategically important, but also as something that needs to be shaped carefully to avoid turning Amazon into a commoditized backend.

From an investor’s point of view, this points to durability rather than disruption. Amazon still owns the hardest assets in ecommerce, especially logistics. Agentic interfaces change how demand is routed, but they don’t make those assets less valuable.

eBay: A Neutral Marketplace That Fits Agents Well

eBay sits in an interesting middle ground when it comes to agentic commerce. It doesn’t own logistics like Amazon, and it doesn’t act as a full-stack merchant backend like Shopify. Instead, it runs a large, relatively neutral marketplace with standardized listings, pricing, and checkout flows.

That neutrality may actually be an advantage in an agent-driven world. AI agents are good at structured comparison, and eBay’s inventory is already organized around searchable attributes, condition, price ranges, and seller reputation. From an agent’s perspective, that’s a clean environment to operate in.

eBay management has hinted in the past that AI-driven discovery and automation are areas of focus, especially around search relevance and buyer efficiency. The company’s incentives are also simpler: more completed transactions, regardless of where discovery happens. Unlike Amazon, eBay has less reason to protect a single dominant interface, and unlike Shopify, it doesn’t need to serve millions of independent backends.

For eBay stock, agentic commerce isn’t a dramatic growth narrative, but it could quietly improve conversion efficiency. If agents increasingly act as comparison engines that route demand toward the best value option, eBay’s broad, price-transparent marketplace could benefit without requiring heavy reinvention. The risk is mostly one of execution: eBay needs to make sure its APIs, listings, and checkout flows are easy for agents to interact with, or it risks being bypassed in favor of more standardized platforms.

In that sense, eBay feels less like a headline winner and more like a system that could age well if agentic commerce grows gradually rather than all at once.

Infrastructure Starts to Matter More Than Storefronts

One side effect of agentic commerce is that attention shifts away from front-end design and toward the pipes underneath. Payments, identity, fraud prevention, and authorization become more central when purchases happen with fewer explicit human actions.

Market observers have started to describe this as a convergence of decision-making and execution, where systems need to be both intelligent and trustworthy. Analysts at McKinsey have highlighted agentic commerce as an area where standardised transaction infrastructure becomes increasingly important as autonomy increases.

This tends to reward platforms that are consistent and boring in the right ways. Clean APIs, stable data models, and predictable behaviour matter more than flashy features when software is the one doing the buying.

What to Take Away

Agentic commerce doesn’t remove ecommerce platforms from the picture. It changes which layers capture leverage.

Interfaces become more fluid and interchangeable, while execution concentrates in systems that agents can rely on without special handling. Shopify is leaning directly into that shift by trying to be the neutral execution layer. Adobe has strong pieces but less cohesion at the transaction boundary. Amazon remains dominant, though more constrained by its own scale and incentives.

For investors, it’s worth thinking of agentic commerce less as a feature upgrade and more as an interface transition. Over time, the companies that quietly control how intent turns into a paid order are the ones that tend to compound, even if they don’t own the most visible part of the experience.